How Asset Managers Can Leverage a Scalable Data Platform for Agility and Operational Excellence

FINBOURNE Technology’s recent workshop with industry experts David Pierson (Director, Omba Advisory and Investments Ltd), Chris Mills (Managing Director, Citisoft) and Thomas McHugh (CEO, FINBOURNE Technology) provided valuable insights on how asset managers can leverage scalable data platforms and enhance decision making.

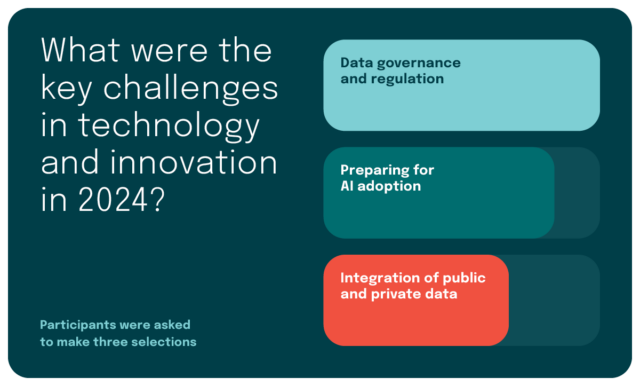

Q: What were the biggest challenges for asset managers in 2024 regarding technology and innovation?

When polled, the audience stated data governance and regulation as being the main challenges this year, followed by preparing for AI adoption and the integration of public and private data.

Given the tough environment customers are operating in right now, cost also remains a significant factor.

Thomas McHugh said: “While we are seeing some money come back into the asset management industry as a whole, the past couple of years has seen incredible outflows from traditional active equity fund managers.”

“So, the question is, what can asset managers do to bring money in and how can they make operations and technology more efficient? This often leads to trimming the workforce and ultimately outsourcing. The appetite to invest in funds has seen pressure and it’s all about delivering that yield and this is driven by insights or alpha and that alpha is driven by data.”

Chris Mills highlighted, “More data doesn’t mean better data. Above everything, it emphasises the need for quality.” For example, the pressure to integrate public and private data sources to give a total portfolio view requires a much broader and deeper understanding of how to combine good, quality data from structured and unstructured sources. Data needs to answer key business questions whilst also being cost-efficient in its usage.

David Pierson added, “For us, avoiding data duplication and addressing governance and security concerns are paramount. That’s why we’re leveraging innovative data virtualisation technology to address these challenges.” As firms grapple with these issues, it’s evident that the business, not just the operations or tech teams, must own the data agenda.

Q: What are the essential components of a scalable data platform, and why are they crucial?

The workshop reinforced that a scalable data platform is more than just a tech solution; it’s a business enabler. By prioritising governance, leveraging automation, and adopting AI judiciously, asset managers can navigate today’s challenges and position themselves for future success.

The panel agreed that building a scalable data platform requires a clear strategy. “There isn’t a one-size-fits-all approach, but firms need a functional operating platform that aligns with their specific outcomes.” Thomas McHugh.

Key components include:

- Automation to streamline operations.

- AI and ML capabilities for advanced analytics and decision-making.

- Robust data governance to ensure compliance and quality.

“Everyone wants a ‘golden copy’ of the data,” said McHugh, “because with that, you unlock a huge amount of power.” However, he cautioned against overcomplicating infrastructure with data warehouses that may not address real-time needs. Instead, focusing on telemetry and dynamic, in-line controls can offer better outcomes.

David Pierson shared a common challenge: “When you ask the business what data they need, the answer is often all of it, all the time, forever. That’s where prioritisation and governance come into play.”

Q: How should firms approach vendor selection to ensure scalability and longevity?

Selecting the right vendor is critical for firms looking to ensure both scalability and longevity in their data management solutions. A careful, strategic approach to vendor selection can lay the foundation for long-term success by ensuring that the chosen solution can grow with the firm’s evolving needs while remaining reliable and adaptable over time.

According to Citisoft’s Chris Mills, it is important to start with alignment of the vendor’s business strategy, their product development and evolving services offering. They may be focused on pure software delivery or expanding their global or functional services to offer firms optionality in their operating model. He suggested, “ask how closely their direction of travel matches yours. Once aligned, you can build longevity.”

McHugh underscored the importance of scalability: “A replacement system must not only meet immediate needs but also support long-term growth and adaptability. Vendors’ vision and motives matter.”

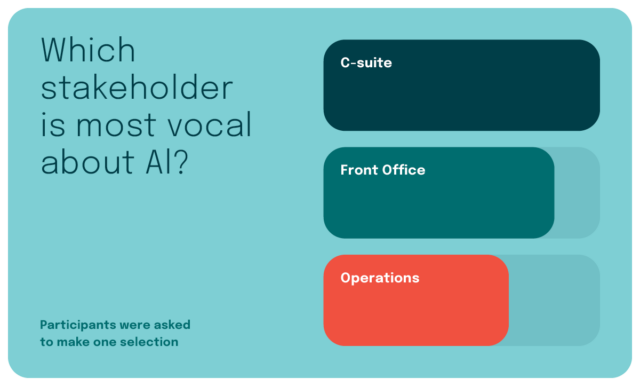

Interestingly, the audience identified the C-suite as the most vocal stakeholder group driving AI conversations. This underscores the strategic importance placed on AI by leadership, even as operational teams grapple with the complexities of implementation.

Q: Will the AI hype translate into measurable business value by 2025?

The hype around AI has certainly created high expectations in recent years, but whether it will translate into measurable business value by 2025 is a nuanced question. It depends on several factors including how businesses implement AI, the specific use cases they target, and the pace of technological advancements.

In a poll, C-suite, front office and operations were shown to be the most vocal stakeholders regarding AI use and adoption.

Chris Mills was pragmatic, having seen hundreds of AI ideas typically whittled down to a handful in practice. The differentiating use cases are at the extremes: in the core of operations or at the external client: “If AI delivers value, it will likely do so in the retail space first. For asset managers, the focus should be on immediate, tangible benefits, like improving client service.”

David Pierson suggested a measured approach: “AI adoption must be gradual, addressing specific needs and scaling case by case. Cultural and data constraints can’t be ignored.”

Thomas McHugh emphasized explainability: “The real value of AI lies in its ability to explain decisions. It’s less about the ‘yes’ or ‘no’ and more about understanding why a decision was made and how to act on it.”

About FINBOURNE Technology

To learn more about FINBOURNE and how our solutions empower asset managers to better serve clients in a constantly evolving market, speak to an expert today.

Sign up for updates

Get our top content on data strategy for the investment world in your inbox regularly

Subscribe