- Full oversight of investor activity in one platform

- Track transactions, run real-time NAV/GAV valuations, manage distributions, and ensure compliance

Challenge

- Managing investor data, transactions, and compliance across siloed systems and channels increases costs, errors, and delays.

FINBOURNE Solution

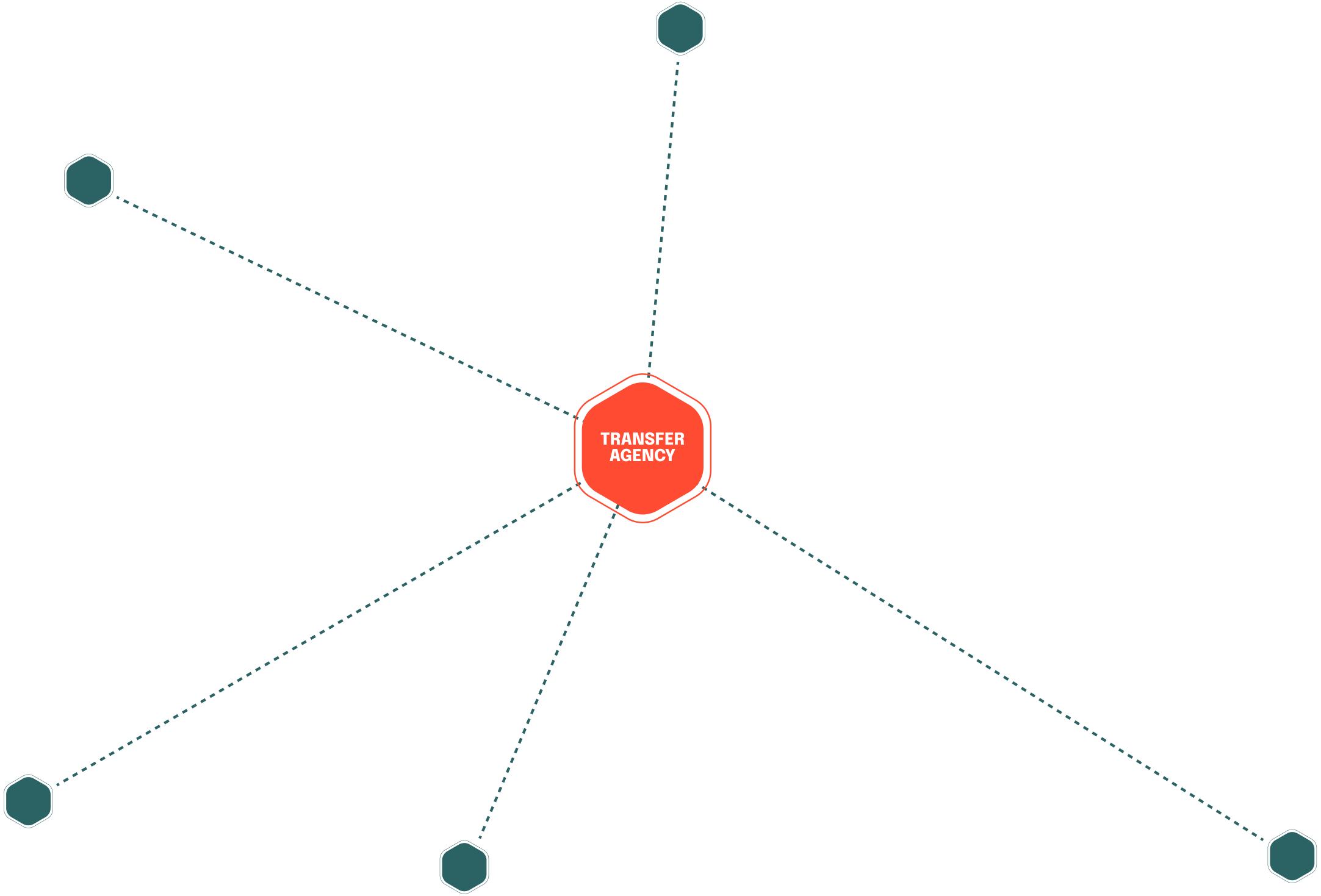

- FINBOURNE unifies registers, valuations, and distributions on one platform, ingesting communications from all sources. With direct distributor connectivity and end-to-end automation, we cut costs, reduce errors, and accelerate investor servicing.