Optimised asset management via FINBOURNE & SIX partnership

At-a-glance

Omba Advisory & Investments Ltd required high-quality market data paired with sophisticated and seamless delivery and integration. Data from SIX Financial Information was delivered and integrated into their processes via FINBOURNE’s interconnected data network for data ingestion, storage, integration, analysis, and delivery. The result for Omba is reporting, valuation, research, and portfolio management processes optimized for efficiency, speed, and quality.

How the Partnership Took Shape

Omba

To deliver the best outcomes for their clients, Omba required a combination of near real-time API-sourced data and end-of-day pricing to support business processes and align with their architectural principles.

SIX

SIX leverages the valuable insight and core competencies of diverse partnerships to ensure continuous innovation and provide unparalleled data access, and lead data-driven financial services globally. The partnership with FINBOURNE enables flexibility and scalability for end users, plus secure and clean ingestion of SIX data.

FINBOURNE

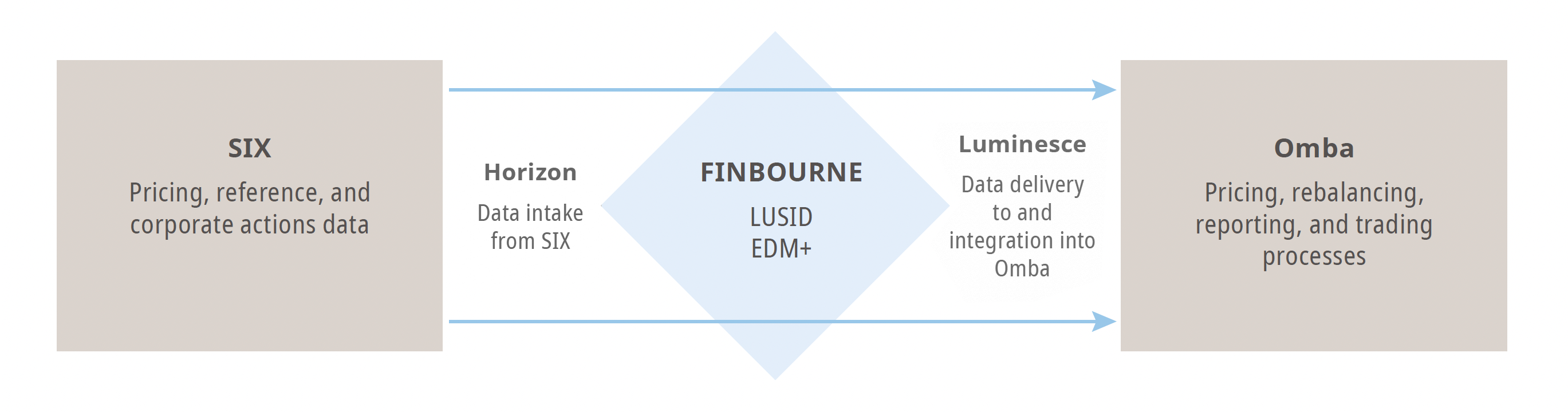

To answer the call of data providers for efficient data storage and integration, and financial institutions’ requirements for high quality data that seamlessly integrates into their internal tools, FINBOURNE created an interconnected data network for data ingestion, storage, integration, analysis, and delivery.

FINBOURNE’s technology serves as the conduit between SIX and Omba, ensuring a standard process for data intake, transformation, and delivery. FINBOURNE‘s EDM+ data management solution enabled Omba to rapidly integrate SIX customised data with LUSID to support a number of critical processes, including:

1. Valuations & Reporting

Use of close-of-day market data from multiple global exchanges to support va-luation, reporting, and per-formance calculations.

2. Portfolio Management

Using intraday market and pricing data from SIX to sup-port portfolio analysis and rebalancing activities.

3. Research & Shadow

IBOR Use of SIX Corporate Action Data to support research, valuation, and shadow IBOR functions.

The Outcome

By leveraging the FINBOURNE and SIX integration Omba can:

- Provide their client portal and reporting solutions with high-quality reconciled data from SIX and rigorous data quality control using FINBOURNE’s LUMINESCE data virtualisation engine.

- Move away from legacy file transfer methods like (S)FTP, using FINBOURNE’s EDM+’ data virtualisation capabilities and creating an “always-on”, real-time data layer for use in portfolio management activities and LUMINESCE queries.

- Use SIX as a single source of market data to identify pricing issues across disparate custodian data sources and use that reconciled data for consolidated reporting.

- Improve order execution efficiency by supporting straight-through processing, compliance, and trade automation with near real-time data.

The SIX and FINBOURNE partnership provides Omba with a scalable platform and high-quality data to empower sound decision-making. Their processes are optimised by bringing together best in class financial market practitioners and financial service providers – increasing the efficiency of their operations and therefore the value they provide their clients.

The enablement of market data from SIX data provides our Portfolio Management and Operations teams with seamless access to accurate pricing and reference data allowing them to rapidly respond to changing market conditions in managing clients’ portfolios.

Coupled with the LUSID integration it is a key component of our Enterprise Architecture and represents a significant step forward

in delivering near real-time, reconciled data to drive more informed decision-making and enhance operational efficiencies.

About FINBOURNE Technology

FINBOURNE combines extensive technical expertise in financial services data management with a best-in-class, open, cloud-based investment management and servicing product ecosystem. By deploying our solutions, our clients can better aggregate, manage and utilise data across their organisations.

With operations across North America, the UK and Europe, Asia and Australia, FINBOURNE’s data management solutions help financial services firms improve their investment management and servicing capabilities.

FINBOURNE is trusted by some of the world’s leading financial services firms, including Fidelity International, London Stock Exchange Group, Baillie Gifford and Northern Trust.

About Omba Advisory & Investments Ltd

Founded in 2017, Omba offers wealth, asset management, and advisory services for family offices, high-net worth clients, and independent financial advisors. Specialising in exchange-traded funds (ETFs), Omba builds and manages globally diverse, low-cost portfolios of ETFs, which are robustly managed through a transparent process to deliver value to investors.

One of Omba’s core principles is to “Embrace Technology” and since its inception Omba has understood the need to ensure operational efficiency to deliver maximum value to clients.

About SIX

SIX is a global financial services provider supporting the entire value chain. SIX ope-rates the Swiss, Spanish and Digital Stock Exchanges, providing post trade services in domestic and global markets. SIX Financial Information provides global data services and solutions. The Group also orchestrates Banking Services on behalf of the Swiss National Bank.

The company is owned by its users (120 banks). With a workforce of 4,044 employees and a presence in 20 countries, it generated ope-rating income of CHF 1.5 billion and Group net profit of CHF 185.0 million in 2022. www.six-group.com