The seismic shift towards digital transformation

FINBOURNE Technology and Alpha FMC recently hosted an industry roundtable in London for the Chief Operating Officers of 11 leading asset managers.

Emerging technologies like cloud computing, and data analytics are now taking centre stage in our industry. Artificial Intelligence (AI), once a buzzword is fast emerging as an industry full of opportunity, fundamentally altering how businesses operate and deliver value to their clients. With organisations moving away from traditional processes to embrace digital solutions, participants discussed the impact of rapidly evolving technologies to drive innovation and increase efficiency. But amid this new era of technology, how are firms preparing themselves for the future?

The input from the discussion has been collated into this report to explore best practices from data management and the integration of third-party systems to the adoption of AI in the asset management industry.

Topics dicussed

- Overcoming data quality and integration challenges

- How can embracing a data ecosystem unlock business value?

- Are asset managers ready for an AI-driven future?

Emerging technologies like AI are reshaping the entire operational landscape. It’s an exciting time for firms to rethink their processes and embrace digital innovation.

Firms that leverage emerging technologies effectively will be better positioned to enhance decision-making, drive efficiency and create long-term value.

Overcoming data quality and integration challenges

Challenges and opportunities of digital transformation: from legacy system drawbacks to futureproofed data management strategies that drive operational resilience.

The explosion of data now available has created opportunities for asset managers, but in some ways has also become an insurmountable challenge.

With the data landscape changing, firms are being forced to develop bespoke trading and data systems in-house, which are costly and complex to maintain.

The rise of software-as-a-service (SaaS) has made it easier to buy off-the-shelf data management solutions that include warehousing, workflow management and bi-temporality. As a result, the industry is witnessing a shift from custom-built systems to technology becoming more commoditised, with holistic systems that offer increased automation and efficiency.

Main challenges for COOs

- Fragmented legacy systems

- Data quality

- High system integration costs

Navigating data integration

Integrating technologies often uses hundreds of data sources, tools and platforms.

Historically, asset managers mostly interacted with dashboards and workflows. However, we are now seeing a big shift in analytics across more products which makes it even more challenging to analyse information.

Accurate performance attribution remains one of the biggest challenges along with handling data on behalf of customers, which requires onboarding customer data that firms do not produce or directly own.

Given the variations in client requests, the existing multiple systems in place to address specific needs brings several challenges related to building data solutions.

Firms are using data warehouses to transform and optimise raw data. Offering the crucial ability to import, validate and analyse large quantities of data, users can accurately measure data quality and performance, thus building better experiences and outcomes.

How can embracing a data ecosystem unlock business value?

Capitalising on a data-first approach: exploring best practice for the integration of cutting-edge technologies and seamless data and process interoperability.

Building a cohesive data ecosystem is challenging with different teams prioritising distinct aspects from governance, platform setup, data management, front-office processes, and client data dissemination. Each company will approach these priorities differently, shaping how their data infrastructure evolves from the outset. Effective data integration requires balancing these areas, to create a unified and efficient system.

While “buy the best and integrate the rest” offers flexibility and capability, cost pressures make it difficult to sustain top-tier solutions in every area. This has led to the rise of enterprise systems and data platforms, which, though sacrificing some specialised capabilities, provide a more integrated dataset from back to front.

Data literacy and governance are key challenges

Ensuring accurate performance calculations inherently drives data quality, as performance data must be complete, accurate and auditable to meet fund managers’ expectations.

Building trust in data is essential, especially within investment teams. However, even when technical infrastructure is solid, end users may question the data’s accuracy and timeliness and achieving consistency across regions with varying calculation methods is a significant challenge. It requires a centralisation of data and a top-down cultural shift to support a move away from siloed processes.

Furthermore, shifting the mindset from data being a technology problem to it being seen as a wider business responsibility, emphasises that ownership lies with those who rely on the data. So, are we beginning to see businesses successfully harness AI’s potential to drive value in a way that the hype surrounding it would expect?

Education is important to long-term success in improving data quality and usability.

Encouraging business stakeholders to understand their role in the data ecosystem helps them recognise their responsibility for data quality and accuracy. By embedding data skills within each team and ensuring that the business owns the data are important components of building a strong data culture.

Are asset managers ready for an AI-driven future?

With a robust data infrastructure in place, how important will the seamless integration of AI-led services be to the future of investment operations?

Emerging technologies like AI are becoming increasingly relevant in asset management. Machine learning (ML), natural language processing (NLP), and large language models (LLMs) all offer substantial opportunities to translate data into actionable insights and thus provide differentiated outcomes.

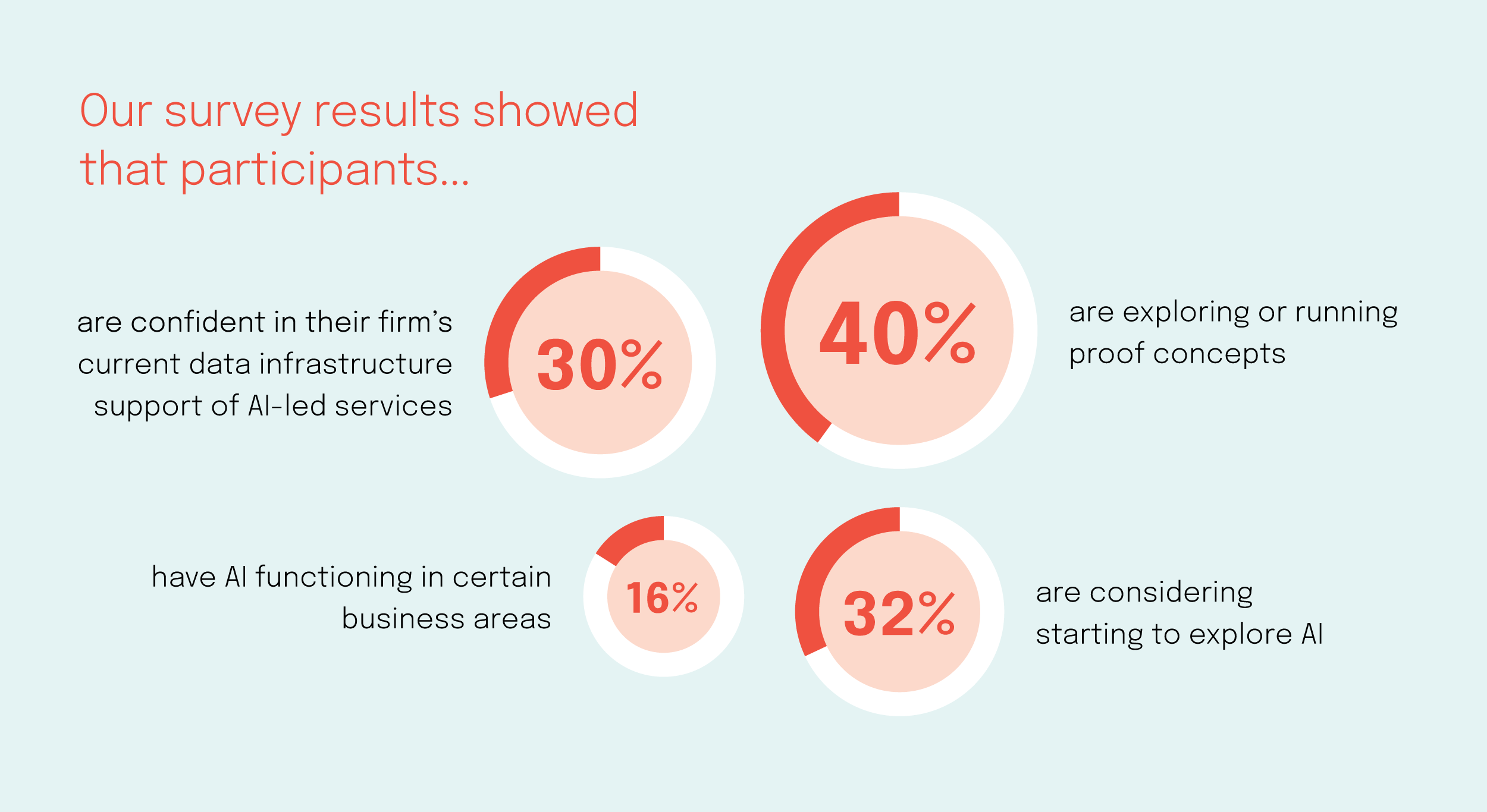

While AI has the potential to enhance operating margins for a broad range of industries, business adoption remains slow. Many companies are still in the early stages of leveraging AI and are not confident that their data is ready to support AI technologies.

But with the ever-evolving data landscape, some organisations are beginning to evaluate the effectiveness of AI tools, particularly for use cases like Due Diligence Questionnaires and Request for Proposals, with many participants suggesting a 60% success rate. This indicates potential but also highlights some limitations.

Many are only now starting to explore effective deployment strategies whereby they have an ability to streamline workflows by allowing users to easily upload and manage their files. However, many firms still feel they are behind the curve in terms of AI implementation but are looking at viable ways to join the AI journey over the next several years and embrace innovative technologies that will reshape the industry and enhance their decision-making.

Participants showed a general willingness to incorporate AI into the investment process, but trust in technology does not yet extend to all areas of the investment process. There is also a recognised need for human oversight, as fully automated solutions are not yet viable for critical functions.

If the underlying data has no quality control, this can result in errors in risk calculations, financial reporting, and regulatory compliance.

However, interest is increasingly emerging around integrating technologies like Microsoft Copilot, ChatGPT or Azure Open AI with existing systems to simplify interactions, manage request most notably for client reports or specific fund information or handle responses more effectively.

This indicates there is a potential shift towards more advanced applications with companies thinking about ways they can prioritise innovative solutions that enhance existing processes, rather than waiting for perfect data sources to become available.

Whilst AI can certainly act as a feature and capability in an overall workflow, to get there, firms need to improve the quality of their data fed into models to improve their accuracy and get adoption and buy-in from end users.

AI can streamline key processes and improve decision-making, but the future lies in finding the right balance between innovation and human oversight.

Conclusion

As asset managers embrace digital transformation, COOs face several challenges and opportunities in modernising their operations. To that end, our delegates shared three key pieces of advice:

Prioritise a modern data infrastructure to address data quality and integration challenges.

Ensuring accurate and auditable data is essential for performance calculations, data management, and compliance. Investing in robust data management tools such as data warehouses can significantly improve data accuracy and decision-making.

Make data a business responsibility.

Encouraging business stakeholders to understand their role in the data ecosystem helps them recognise their responsibility for data quality and accuracy. By embedding data skills within each team and ensuring that the business owns the data are important components of building a strong data culture.

Find the balance between AI and human oversight.

While many firms are exploring AI-led services, trust in these technologies must be built through enhanced data quality and human oversight. Achieving the right balance between automation and human expertise will be key to realising AI’s full potential in the investment process.

To find out more about the growth opportunities that are coming from digital transformation and how you can improve the efficiency and resilience of your investment operations, speak to an expert at FINBOURNE Technology today.

About Alpha FMC

Alpha FMC is the leading global provider of specialist consulting services to the asset and wealth management industries. We help asset and wealth managers think smarter and shape their business for the future. FINBOURNE’s solutions deliver an interconnected network of functionality and data that enables the investment community to better serve clients in a constantly evolving market.

Our depth of expertise covers the entire investment management operating model, including data operating models and architecture, we offer both advice and hands-on solution delivery through our range of specialist practices.

For more information on Alpha FMC please visit alphafmc.com or contact enquiries@alphafmc.com

About FINBOURNE Technology

FINBOURNE’s solutions deliver an interconnected network of functionality and data that enables the investment community to better serve clients in a constantly evolving market.

Its investment management solutions and cloud-native data management platform ensure that investment and operations teams can increase revenue, reduce costs, and better manage risk across the investment life cycle.

For more information on FINBOURNE Technology visit finbourne.com or contact talk@finbourne.com